Consultancy

Consultancy

We advise our clients comprehensively, evaluate opportunities and risks, and develop customized, sustainable strategies for direct and indirect real estate investments.

Always with a long-term focus, continuity, and risk awareness.

Analysis

Analysis

For over 30 years, we have been analysing the Swiss real estate market and its investment products.

In addition to quantitative aspects, qualitative factors such as management principles, cost discipline and the creation of long-term added value play a significant role.

Strategy

Strategy

We assess your real estate portfolio, evaluate and create holistic and sustainable strategies and support you through the implementation process.

We facilitate strategic partnerships and generate synergies for additional development and value enhancement potential.

Networking

Networking

Thanks to many years of experience and the network we have built up as a result, synergies and connections are created between property owners, investors, asset managers and service providers.

With this approach, we built bridges between direct and indirect property investments, private and institutional investors as well as between French- and German-speaking Switzerland for our clients.

Mandates

Mandates

We develop a suitable real estate strategy for you on a mandate basis.

The continuous personal dialogue ensures the ability to respond to changing preferences or market situations at any time. This can also take the form of participation in bodies such as investment committees, boards of directors or trustees.

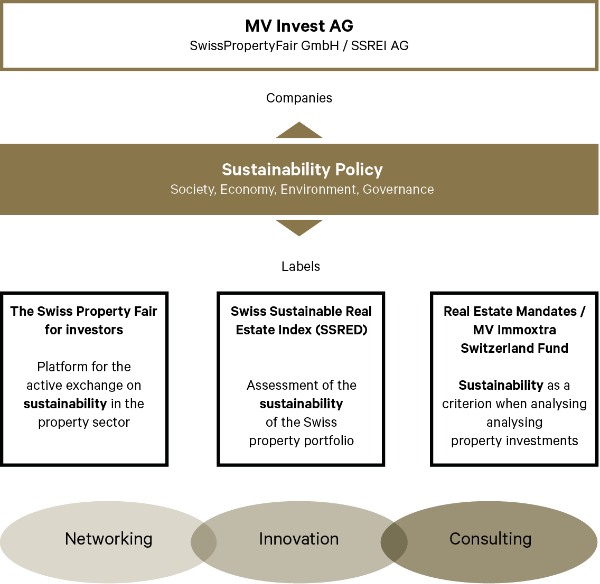

Sustainability

Sustainability

Our proprietary sustainability model allows us to evaluate all listed and non-listed Swiss real estate products (stocks, funds, investment foundations) and provide institutional investors with sustainability reporting.

With the Swiss Sustainable Real Estate Index (SSREI), a standard for assessing the sustainability of the Swiss building stock was launched as well.

Market Commentary March 2024

The decision by the Swiss National Bank (SNB) to cut interest rates by 0.25% to 1.50% seemed largely priced into the stock prices of real estate funds...

Market Commentary March 2024

The decision by the Swiss National Bank (SNB) to cut interest rates by 0.25% to 1.50% seemed largely priced into the stock prices of real estate funds. The cut now translates into more attractive conditions for short-term refinancing. It seems that further increases in the reference interest rate are likely off the table. In order to develop an action plan regarding housing shortage and tenant protection, a special session chaired by Federal Councillor Parmelin was held: Core measures include simplifications in approval procedures, strengthening of indirect housing subsidies and a reduction of the high degree of regulation, for example regarding noise protection. This is a positive signal for pending and future development projects – portfolios with land reserves and ongoing construction projects are thus likely to yield higher returns for investors. UBS predicts that due to sustained strong demand, driven by high migration balance, surplus births, and simultaneously low construction activity, price increases can be expected for residential properties. Regionally, however, price developments can vary: While lower transaction levels and consequently valuation discounts have been observed in Geneva, the Zurich market remains consistently stable. Price volatility historically tends to be higher in the Lake Geneva region – this, in turn, offers opportunities for active long-term investors. Unfortunately, current capital increases are not always launched with this intention. Several funds prefer to increase redemption fees and tap into their reserves for high dividend payouts, rather than positioning themselves for future attractive opportunities in the interest of investors. Real estate stocks such as Espace Real Estate, Plazza, Warteck, or Investis demonstrate their high level of activity in the annual reports, which should be reflected in significant excess returns in the medium to long term. The acquisition of Fundamenta by Swiss Prime Site, meanwhile, indicates that the expected market consolidation is finally gaining momentum – a healthy, necessary development.

The Market Commentary newsletter - subscribe here!

Market Commentary April 2024

The real estate funds were unable to sustain the strong growth seen over the past 5 months. Profit-taking has set in, which could have various reasons...

Market Commentary April 2024

The real estate funds were unable to sustain the strong growth seen over the past 5 months. Profit-taking has set in, which could have various reasons. Of particular concern are the high premiums on residential real estate funds, sometimes exceeding 40%. In contrast, real estate stocks with similar portfolios are still trading at a discount. The announced capital increases have led to an overload and cooling off of the real estate funds. The lack of conviction among some managers to justify additional engagement is leading to a loss of trust. Opinions on the potential of the planned merger between Novavest and SenioResidenz differ: while the boards of directors are enthusiastic, Novavest's share price has fallen since the announcement. Are the anticipated benefits for investors simply not tangible enough? The uneven distribution of benefits in the exchange ratio was unfortunately not adequately considered. Additionally, both portfolios carry different risks. Shareholders will have the opportunity to decide on the proposal at the extraordinary general meeting. While real estate funds are structured like preferred shares and therefore do not have voting rights, shareholders can and should defend their interests. The restructuring of Ina Invest's structure has been approved. Shifting a larger block of shares brought in a new major shareholder, which was welcomed by the market. Procimmo is restructuring by terminating the contract with their fund management, which will now be handled internally. The merger of the fund managements of UBS and CS is now just a formality; further considerations will likely be presented by UBS by the end of the year. As inflation in Europe continues to decline and an interest rate cut by the ECB becomes more likely, it is now certain that a rate cut by the Fed will be further delayed. The extent to which this will influence the upcoming decisions of the SNB remains to be seen. We can envision a scenario in which the SNB promptly makes the next downward interest rate move, prompting larger investors to adjust their allocation towards real estate investments at the expense of bonds.

The Market Commentary newsletter - subscribe here!

Expansion of the Board of Directors of MV Invest AG

MV Invest AG is strategically strengthening its Board of Directors with the appointment of Erhard Lee and Stephan Keller...

Expansion of the Board of Directors of MV Invest AG

With the appointment of Erhard Lee and Stephan Keller, MV Invest has succeeded in strategically strengthening its Board of Directors. With these notable additions, the company hopes to further strengthen its position as an innovative and dynamic consulting firm for direct and indirect Swiss real estate investments.

Press release

Erhard Lee has been active in the financial industry for over 40 years, holding various positions at different renowned institutions. After completing his bank apprenticeship at the private bank Rüd, Blass & Cie, he was head of trading at BZ Bank Zurich, portfolio manager at Bank Leu and partner and member of the executive board at Actieninvest and Schaller Management + Consulting. In 2001, he founded AMG Analysen & Anlagen AG as sole owner and has also been Chairman of the Board of Directors of AMG Fondsverwaltung AG since 2013. Erhard Lee is a qualified business economist, stockbroker, analyst and asset manager.

Stephan Keller has been advising and representing companies in corporate and construction law matters for over 18 years. As a lawyer, he runs his own law firm, KELLER Attorneys at Law, in Zurich with 4 employees. Together with his twin brother, he is also the owner of a 5th generation family business in the construction industry. In this context, he manages the real estate division and is Chairman of the Board of Directors of the parent company. Stephan Keller has a background in business administration and jurisprudence, is a member of the board of directors and advisory board of various Swiss SMEs and has been registered with the athorny register since 2002.

Our team for your goals.

Expertise, passion, and anticipation lay the foundation for us to fully focus on your needs

Roland Vögele

CEO

+41 43 499 24 90

Sacha Deutsch

Senior Advisor

+41 43 499 24 91

Ulrich Kaluscha

Senior Advisor

+41 43 499 24 96

Raphael Schuler

Senior Sales

+41 43 499 24 92

Remo Burri

Senior Office Manager

+41 43 499 24 94

Leonie Eberhardt

Event/Marketing Manager

+41 43 499 24 93

Debora Zgraggen

Event/Marketing Manager

+41 43 499 24 89

Elodie Gadola

Event/Marketing Manager

+41 43 499 24 93

Elvira Bieri

Chief Sustainability Officer

CEO SSREI AG

+41 43 499 24 99